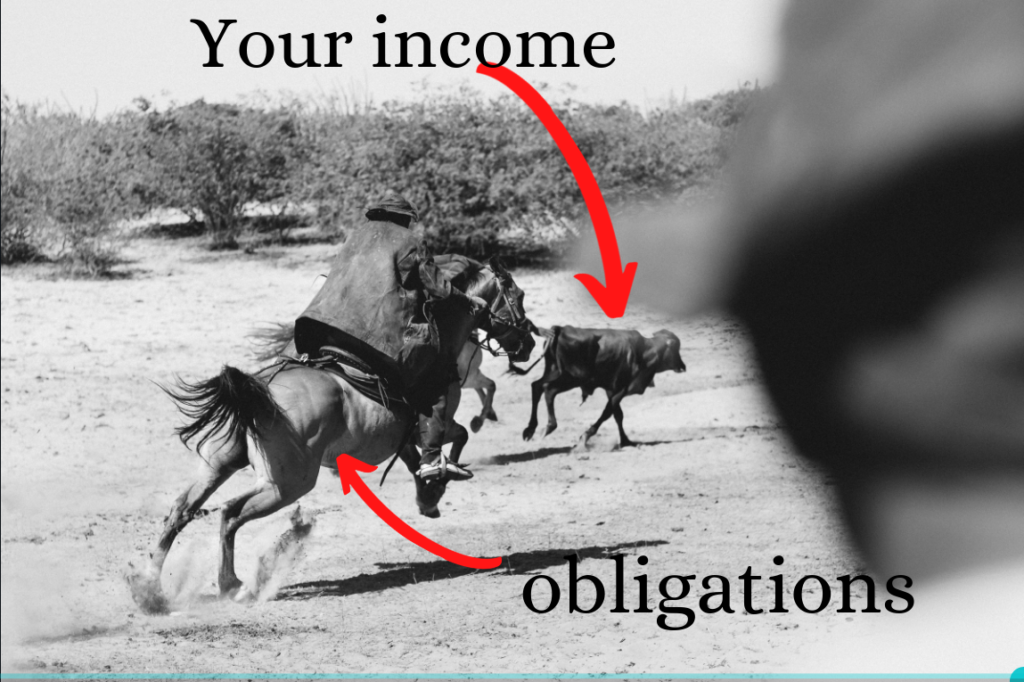

So! your income is small but your obligations are so many. It is a very stressful situation. The reality is there are some things we can control and others we cannot control. In this article, we are going to dig deep into the relationship between expenditure and income. Of course, we will focus on things that we can only control.

Expenditure comes after income and you should never spend what you don’t have.

Most of us if not all have felt that they were being chased by a ton of obligations after they receive their income. These obligations can often be something not of our making. However, more often than not it’s a problem we create unintentionally by failing to understand the relationship between expenditure and income. The basic understanding is expenditure comes after earning and you should never spend what you don’t have.

1. Before your income

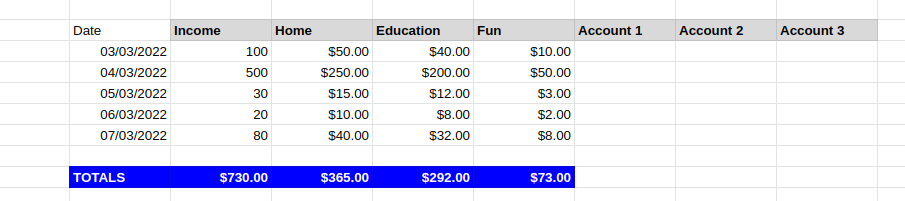

Before your salary/income comes you need to have accounts/envelopes to put your money. You look at your life and see what classifications do you spend your money on. For instance, you have a Home classification (this has to do with money for rent and food), Education (all your learning needs), Fun (Pleasure and leisure). The next thing you apportion your income into these accounts e.g. home takes 50%, education takes (40%), fun takes (10%). Essentially every income you get is spread across these accounts/envelopes. You make a $100 Home takes $50, Education takes $40, Fun takes $10.

Most people now have side hustles and will earn more than once a month. The problem is we know that when we make money we are going to spend it on rent, education and fun but we are not methodical in how we save or spend it. We end up happening spending on whatever is demanding at that moment. However, If you apportion your earnings towards those accounts, at the end of the month there is money waiting to meet those obligations.

2. When your money comes

When your money comes you must have the discipline to transfer it to those accounts we spoke about or if it’s cash put it in the right envelope. Please see the screenshot below

By the end of the month, you will be having $73.00 waiting for you to spend on fun and $292 going towards your education. You keep that up for a year you have saved $3504 towards education.

3. When you spend on obligations

When you spend the money it’s easy, you take from the appropriate account and use it any time of the month. As long as there is money in the account, spend as earmarked. By doing this you are obeying another rule of money that says “never spend what you don’t have”. This is to say that if something comes up that was never earmarked you will not spend on it because you “don’t” have it. You have not earned any money towards this.

This gives you peace of mind and contentment because you can see what you have and do not have. This is where the discipline comes from.

When you want to spend on a new thing

You have to make adjustments to your existing account to accommodate the new thing. Suppose you want to buy a car, you must create a new account or envelope and give it a new percentage as you see fit. Then repeat steps 1 to 3. It does not matter if your income is small and there are many obligations the key is managing what you get and finding contentment.

Katubu is a fountain for self-improvement. After reading an article from Katubu a visitor must feel that it has opened their mind eventually becoming a better person. Articles range from Life, Business, Education, Health and more

No Comments

Leave a comment Cancel